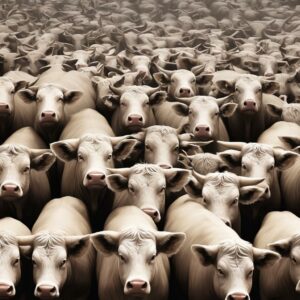

Herd behavior, a phenomenon rooted in psychology, plays a significant role in shaping stock market dynamics. In this article, we’ll delve into the psychology behind herd behavior in the stock market and its implications for investors.

Understanding Herd Behavior in the Stock Market:

Herd behavior refers to the tendency of individuals to follow the actions of the crowd rather than making independent decisions. In the context of the stock market, herd behavior manifests when investors mimic the actions of others, often leading to exaggerated price movements and market bubbles.

Psychological Drivers of Herd Behavior in the Stock Market:

- Fear and Greed: Emotions such as fear and greed are powerful drivers of herd behavior in the stock market. During periods of market volatility, fear can cause investors to panic sell, triggering a domino effect as others follow suit. Conversely, greed can lead to irrational exuberance and asset bubbles as investors chase momentum.

- Information Cascades: In the absence of complete information, investors rely on signals from others to guide their decisions. When a critical mass of investors begins buying or selling a particular stock, others interpret this as a signal of value or risk, prompting them to follow suit without conducting independent analysis.

- Social Proof: Humans have a natural tendency to seek validation from others, especially in uncertain situations. In the stock market, investors often look to the actions of their peers or prominent figures, such as analysts or institutional investors, for guidance on investment decisions.

- Loss Aversion: Loss aversion, the psychological bias towards avoiding losses rather than acquiring gains, can amplify herd behavior in the stock market. Investors may sell stocks at the first sign of a downturn to avoid further losses, contributing to market sell-offs and exacerbating price declines.

Implications for Investors:

- Herd Mentality: Recognizing and avoiding herd mentality is essential for investors to make rational, independent decisions. It’s crucial to conduct thorough research, maintain a long-term perspective, and resist the urge to blindly follow the crowd.

- Contrarian Investing: Contrarian investors capitalize on herd behavior by taking positions opposite to prevailing market sentiment. By buying when others are selling and selling when others are buying, contrarian investors seek to profit from market overreactions and mispricings.

- Volatility and Risk: Herd behavior can contribute to increased market volatility and systemic risk. Investors should be prepared for sudden price swings and market downturns resulting from herd-induced panic or euphoria.

- Market Efficiency: While herd behavior can lead to short-term market inefficiencies, it also plays a role in driving market prices towards equilibrium over the long term. As more investors recognize and react to market trends, prices adjust to reflect underlying fundamentals.

Conclusion:

Herd behavior is a pervasive force in the stock market, driven by psychological biases and social dynamics. By understanding the psychology behind herd behavior and its implications for investment decision-making, investors can better navigate market fluctuations and position themselves for long-term success.